I recently wrote a post summarizing Dave Ramsey’s book, Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth—and How You Can Too.

While the book itself was OK, what most caught my eye were the results of the National Study of Millionaires that was included as an appendix to the book.

For this study, Ramsey Solutions interviewed over 10,000 millionaires in the U.S. to learn how they made their wealth and to dig into their attitudes, behaviors, and beliefs when it comes to money.

Some of the results were pretty interesting. Here are the ones that stood out to me:

Portrait of a millionaire

Average age of a millionaire

The average age of the millionaires in the study was 63. Only 7% were younger than 45 and three-fourths (74%) were at least 55.

Age when millionaires became millionaires

63% of the millionaires in the study reached this status in late middle age (45 to 64)—37% became millionaires between 45 and 54 years old and 26% did so between 55 and 64.

Only 7% became millionaires by 34 and only 9% after 65.

These last stats highlight both the need for patience and the importance of getting your money right as early as possible.

Unless you’re disciplined and are making a high income in your early twenties, it’s unlikely you’ll reach millionaire status before 34.

These are the years where you’re figuring out your life. It’s a time filled with firsts—full-time job, marriage, house—and movement—dating, moving, switching jobs, traveling. It’s a time of preparation—you’re warming up the engines for the long marathon ahead.

Of course, there are a precocious few who’ll start and sell their own company, Zuckerberg-style, or that’ll hit the jackpot with something like crypto or Tesla stock, but these unicorns are an exception.

On the other hand, our habits are damn hard to change. And it only gets harder through the years.

Since habits have a compounding effect, the earlier we establish good financial habits, the more time we allow for them to take root and grow, and the sooner we’ll reach financial independence.

Total net worth of millionaires

The median net worth for the millionaires in the study was $2,485,000.

A third of the participants were in the $1 to $2 million range and nearly two-thirds were in the $1 to $3 million range.

Only 11% of the millionaires had a net worth over $5 million.

To me, these stats show that becoming a millionaire is doable, but that doing it five times or more is very difficult.

The accumulation of large amounts of money requires high earnings or lots of time, and both of these are difficult for their own reasons.

Remember that net worth is calculated by subtracting your liabilities from your assets.

Liabilities include debt (e.g., credit card) and loans (e.g., student, car, mortgage) while assets include savings and checking accounts, retirement and investment accounts, bonds, and any business or real estate equity, among others.

Where millionaires live

Breakdown of millionaires by US region

Here’s how the states were broken down by geographical area:

- Northeast (9): Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont.

- Midwest (12): Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, Wisconsin.

- South (16): Alabama, Arkansas, Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia, West Virginia. Washington D.C. is included here as well.

- West (13): Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, Wyoming.

This matches the breakdown from the US Census Bureau.

The Northeast and the West are overrepresented in the random sample of millionaires while the South is grossly underrepresented.

This finding matches up pretty well with the ranking of US states by household income.

8 out of the the bottom 10 states are in the South. And Delaware, Virginia, and Maryland are the only southern states in the top 20—and they’re all fairly north.

This 4-part series from the Washington Post covers the pervasive poverty in the Deep South and how it affects those who live there.

The homes of millionaires

It’s a well-covered fact that homes in the US continue to get larger.

In 1973, the average size of a new house was 1,660 square feet. By 2017, this number had jumped by 1,000 square feet to 2,631.1

(In case you’re curious, in the same span, the median size of a new house has gone from 1,525 to 2,426, an increase of 900 square feet.1)

And this increase in square footage comes even while the average household in the US has shrunk from 3 people in 1973 to 2.5 in 2017.2

So while the price per square foot of a new house has remained fairly constant over the past 40+ years3, their ballooning size means that they continue to get more and more expensive.

Chart courtesy of DQYDJ.

The average home size of the millionaires in the study was 2,600 square feet and two-thirds (65%) lived in homes under 2,999 square feet.

My wife and I live in a 1,600 square foot home with four bedrooms and two bathrooms and are overwhelmed by the amount of extra space that we have.

The unfortunate fact, however, is that our model was the smallest one sold by the developer as they prefer to build larger houses which sell for more and require about the same effort to build as a smaller house.

This, in part, explains the housing crisis in the US.

Tons of people would be very happy in a sub-1,600 square foot house, but it’s hard to find one and only getting harder.

For our part, we’ll definitely be looking to downscale into the 1,200 square foot range when we make our next move.4

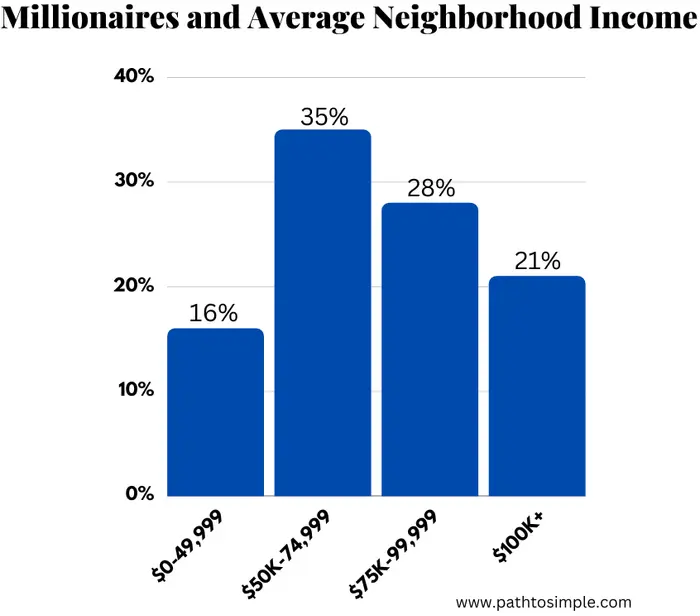

Millionaires and average neighborhood income

Half of the millionaires in the study lived in neighborhoods with a household income under $74,9995 and four in five lived in neighborhoods with a household income under $99,999.

Given that the median household income in the US in 2020 was $67,5216, millionaires in the study tended to live in fairly modest neighborhoods.

This tracks well with the study from The Millionaire Next Door, which found that millionaires are typically normal people who saved diligently through the years, rather than the person with the big house and flashy car who likely has a big mortgage and a car loan.

How millionaires grew up

Income class of millionaires’ household during childhood

47% of the millionaires in the study came from homes where neither parent graduated from college and only 25% came from homes where both parents did.

The majority of the participants (79%) came from lower to middle class families.

The top 10 degrees earned by millionaires

It’s no surprise that business (accounting, business administration, and finance) along with STEM (biology, computer science, and engineering) account for 6 of the top 10 degrees earned by millionaires given that these degrees are among the highest-paid.

The appearance of education in the top 10 somewhat surprised me. This serves as evidence that a high-paying job isn’t an absolute prerequisite for becoming a millionaire.

Level of education of millionaires

Only 10% of the surveyed millionaires got there without a college degree and 87% had at least a 4-year college degree.

Clearly, a college degree is a near-must in today’s world.

It’ll be interesting to see how this changes over the next twenty to fifty years, however, given the rise of non-traditional jobs (people making a living on YouTube, Etsy, or the internet in general) and the recent decrease in college enrollment.

Change seems unthinkable, but just because a four-year extension of high-school is the current model doesn’t mean that it’s the only model that could work.

Personally, I think it’d be super interesting to see apprenticeships hit the mainstream and start becoming a viable alternative to college.

Millionaires and debt

An interesting question included in the study regards the type of debt held by millionaires as compared to the general population, both at the time of the survey and over their lifetime.

Current debt held by millionaires

Some of these numbers immediately caught my attention.

It’s rare for millionaires to hold credit card debt (6%) while it’s fairly common for the general population (40%).

And millionaires are half as likely to have a car loan and 11 times less likely to have student loans.

Though I’m not yet a millionaire, all three of these ring true for me.

I’ve never (and will never) have credit card debt—I pay my card off in full each month and never purchase anything I can’t afford.

The first thing I did when I graduated from school and got my first job was pay off the remaining $30,000 I had in student loans.

And when my girlfriend and I bought our first car together, we decided to pay cash for it rather than take out a loan.

Financial discipline is critical to become a millionaire and having little or no debt is a good barometer of one’s discipline and self-control.

The one debt that is nearly as common for millionaires as for the general population is a mortgage, which makes sense given the high cost of homes nowadays.

Lifetime debt held by millionaires

Other interesting patterns emerge when looking at lifetime debt percentages.

Millionaires are more likely to have had a mortgage loan, indicating that they tend to buy rather than rent.7

Interestingly enough, millionaires are almost nearly as likely as the general population to have had a car loan (65% vs 73%) and only a third of millionaires (29%) ever had student loans.

Again, though, the picture of financial discipline comes through in the fact that millionaires are 7 times less likely to have had past-due utilities and more than twice as likely to have never had credit card debt.

If you have past-due utilities or credit card debt and have a goal of being financially well-off, consider this both a source of inspiration and a wake-up call—you can still be a millionaire, but the time for discipline is now.

Millionaires and spending

What percentage of their income do millionaires save per month?

Almost a third of millionaires (30%) save 20% or more of their income every month and nearly three-fourths (71%) save 10% or more.

Given that the personal savings rate in the US is around 5%, this means that the majority of millionaires save twice as much or more than the general population.

Even so, the savings rates for millionaires are much lower than I expected.

My wife and I generally manage to save over 60% of our income each month, though it’s true that we are on the frugal end of the scale.

I wonder if these numbers are pushed down by older millionaires who are now spending the money accumulated in their working years and are thus either no longer saving or no longer making much income.

How much do millionaires spend on groceries?

The surveyed millionaires spend an average of $412 a month on food.

This number ranges from $231 for lone millionaires to $538 for millionaires in a four-person household to $561 for millionaires in households with five or more people.

For what it’s worth, my wife and I spend between $150 and $200 each month on food. We eat a vegetarian diet that’s heavy on quinoa, oats, eggs, nuts, peanut butter, tofu, fresh veggies, fruit, and beans.

Given that the USDA says that the monthly cost of a thrifty food plan8 is $297.50 for a male between 20 and 50 and $238.60 for a female between 20 and 50, it looks like we spend about a third of the $536.10 that we “should”.

Even the amounts spent by the millionaires in the survey come in well under this amount.

In my opinion, however, whoever came up with this “thrifty food plan” is off their rocker—in no way are any of the amounts they quote “thrifty”.

Beans, potatoes, rice, and pasta cost a dollar per pound. Lots of fresh fruits and veggies cost under two.

It’s true that animal protein (meat, milk, and eggs) can get expensive—though vegan protein (tofu) is fairly cheap—so finding alternatives is a must, but this isn’t particularly hard.

If one expends the minimal amount of effort (i.e., doesn’t buy junk food and shops at Aldi, Walmart, and Costco instead of Whole Foods), eating well in the U.S. is fairly cheap.

Do millionaires use grocery lists?

The millionaires in the study were also asked whether they used a grocery list when shopping.

28% said they made a list and stuck to it; 57% made a list and somewhat stuck to it; and 15% do not make a list.

My wife and I always make a list and we stick to it. We go grocery shopping every two weeks and meal prep every weekend for the upcoming week.

From my experience, planning meals in advance, meal prepping, and using a list when grocery shopping are the three biggest keys to saving money on food.

How much do millionaires spend on restaurants?

The surveyed millionaires spend an average of $267 a month eating out. And two-thirds of them spend less than $300 a month.

The Bureau of Labor Statistics reports that 44% of food spending was spent on eating out and that each household spent $288 a month eating out.

This means that the millionaires in the survey are right on par with the rest of the country.

My wife and I have a restaurant budget of zero dollars with zero cents. We almost never eat out unless we’re hanging out with friends or family.

Since I don’t mind cooking nor washing my own plates, eating out isn’t something I consider a “treat”.

How much do millionaires spend on clothing?

About a third (29%) of millionaires spend under $49 a month on clothing, though the average expenditure is $117 per month.

It’s good to see that money spent on clothing greatly decreases the older one gets—I’m not sure if this is because older people stop buying clothes for work and social outings or if they stop giving a f**k.

I hope it’s the latter.

I also wonder if working from home will decrease the money spent on clothing or if it will just change the distribution from button downs and pants to t-shirts, leggings, and sneakers.

I hope it’s the former, but I’m fairly sure it’s the latter.

Finally, I was also mind-boggled by the fact that one-fifth of the interviewed millionaires spent over $200 a month on clothing.

That’s a lot of money on clothing. It’s likely this spending comes from larger households, but even so it seems like too much.

My wife and I have a clothing budget of zero dollars with zero cents.

She’ll occasionally splurge on some item—a swimming suit or leggings or a shirt or a “cute” dress, especially around the holidays—and I buy new sneakers every other year. And that’s about it.

And even with this vigilance, our closet is stuffed with more clothes than we can wear.

What cars do millionaires drive?

Nearly one-third of the interviewed millionaires drive either a Toyota or a Honda, two fairly affordable brands.

And there are 7 luxury brands (Lexus, BMW, Acura, Mercedes, Audi, Cadillac, and Volvo) in the top 20 which together account for 25% of the market share.

This list mostly matches the market share of car brands in the US, though luxury brands are definitely over-represented. (I wonder how long it’ll take Tesla to crack this list.)

I wasn’t particularly surprised by the over-representation of luxury brands as people in the U.S. love their cars for some reason.

My wife and I drive a used 2018 Kia Soul—though it’s true that our rich alter egos would likely drive a Subaru—which fell outside the top 20.

Summary

The point that Ramsey was trying to make with this study is that anyone can become a millionaire as long as they develop the necessary financial discipline to save and invest over a prolonged period of time.

I think he achieved his purpose.

Though there are plenty of factors—loving parents, access to education, studying a profitable field, etc.—that make it much likelier that one will become a millionaire, it’s undeniable that anyone in the U.S. can reach millionaire status.

Depending on your income and spending habits, it might take you anywhere from five to fifty years, but if you save 20% or more of your income and invest consistently, you’re guaranteed to get there eventually.

If you’re already on the road, keep pushing on.

And if you’ve made a mess of your money so far, don’t despair, there’s still time—get your finances in order, pay off your debts, and start saving and investing.

Best of luck.

Stay in touch!

Enjoying so far? Get my posts delivered straight to your inbox each week. 📨

*If this form gives you any trouble, reach out to me at hi@pathtosimple.com and I’ll help you out.

Footnotes

-

See the 2017 Characteristic Of New Housing report. ↩ ↩2

-

See this figure from the U.S. Census Bureau titled Changes in household size. ↩

-

See the second chart in this post from AEI titled Price per Square Foot for New US Houses Sold, Adjusted for Inflation, 1973 to 2015. ↩

-

My wife and I moved in together in 2018, moved out in 2021, and moved in to our current (and first) house in 2022. So our next move is far in the far future, I hope. ↩

-

The average household income for the neighborhood of the survey participant was determined through zip code analysis. ↩

-

See this table from the U.S. Census Bureau titled Households by Total Money Income, Race, and Hispanic Origin of Householder: 1967 to 2020. ↩

-

The topic of buying versus renting is very emotionally charged. Older generations tend to be deeply convinced that buying is always the right move. This might be due to the importance given to homeownership in the American Dream. But buying isn’t always the right move. As Robert Kiyosaki explains in Rich Dad, Poor Dad, anything we own that brings in money is an asset; anything we own that requires money is a liability. Since a mortgage (not to mention property taxes and maintenance costs) is a monthly outflow of money, our houses are not assets but liabilities. ↩

-

The thrifty food plan represents a “nutritious, practical, cost-effective diet” that follows the Dietary Guidelines for Americans and assumes that all meals and snacks are prepared at home. ↩